RRA disburses Frw 1.3 billion in VAT Rewards to final consumers requesting EBM invoices

Rwanda Revenue Authority (RRA) has disbursed VAT-based rewards, totaling Frw 1,327,986,092 to 157,029 final consumers. This amount is equivalent to…

13.11.2024

Best Taxpayers of the Eastern Province Appreciated

Taxpayers who fulfilled their responsibilities in the Eastern Province during the 2023/24 fiscal…

09.11.2024

Western Province Taxpayers Recognized for Outstanding Tax Compliance

Taxpayers in the Western Province were appreciated for efficiently fulfilling their tax obligations…

07.11.2024

Best taxpayers in the Northern Province Appreciated

Taxpayers in the Northern Province were recognized for fulfilling their responsibilities in the…

04.11.2024

Government launches 22nd Taxpayers’ Appreciation Month

The Government of Rwanda, through the Ministry of Finance and Economic Planning, officially launched…

16.10.2024

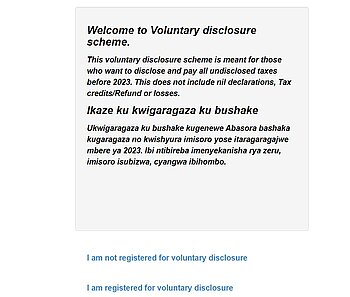

Taxpayers are reminded to take advantage of Voluntary Disclosure scheme as deadline approaches

Rwanda Revenue Authority (RRA) has encouraged taxpayers to voluntarily disclose any taxes they…

05.09.2024

RRA revises payment modalities for taxpayers who voluntarily disclose tax liabilities

Rwanda Revenue Authority (RRA) has revised the payment modalities within the extension period of the…

30.08.2024

CG Niwenshuti urges customs clearing agents to improve their operations

Rwanda Revenue Authority Commissioner General, Ronald Niwenshuti, has urged customs clearing agents…

26.08.2024

RRA Opens 2024 Immovable Property Tax Declaration

Rwanda Revenue Authority (RRA) has opened the declaration process for the 2024 immovable property…

08.08.2024

Government announces key tax policy reforms for 2024/2025

The Government of Rwanda has announced different tax policy changes for the 2024/25 fiscal year,…

05.08.2024

RRA disburses about Rwf 95 million in VAT Rewards to final consumers

Rwanda Revenue Authority (RRA) has initiated the disbursement of about Rwf 95 million in VAT rewards…

10.07.2024

Tax on minerals reduced

Rwanda’s tax on minerals rates have been reduced to between 3% as the highest rate and 0.5% as the…

03.07.2024

RRA tax collections grow by 12.3% for 2023/24 financial year

Rwanda Revenue Authority (RRA) has announced that it has collected Rwf 2,619.2 billion for the…

23.06.2024

191 EAFFPC graduates urged to enhance taxpayer services in Customs

On Friday, June 21st, 2024, 191 individuals graduated after one-year training and obtained…

18.06.2024

RRA eases conditions for taxpayers to settle tax arrears in instalments

Rwanda Revenue Authority (RRA) has simplified the conditions for taxpayers to settle their tax…

11.06.2024

RRA partners with AIMS to enhance performance and service quality through mathematical sciences

On June 11, 2024 Rwanda Revenue Authority (RRA) has signed a Memorandum of Understanding (MoU) with…

11.06.2024

RRA calls on taxpayers to declare the 1st Quarterly Prepayment Tax before June 28th deadline

Rwanda Revenue Authority (RRA) urges business owners to declare and pay the first income tax…

24.05.2024

Government projects Frw 2,970.4 billion in tax revenues for the 2024/25 fiscal year

Minister of Finance and Economic Planning, Dr. Uzziel Ndagijimana, has announced that the total…

13.05.2024

RRA Staff Donates Cows to Genocide Survivors in Gisagara

Rwanda Revenue Authority (RRA), the Office of the Auditor General (OAG), and the National Electoral…